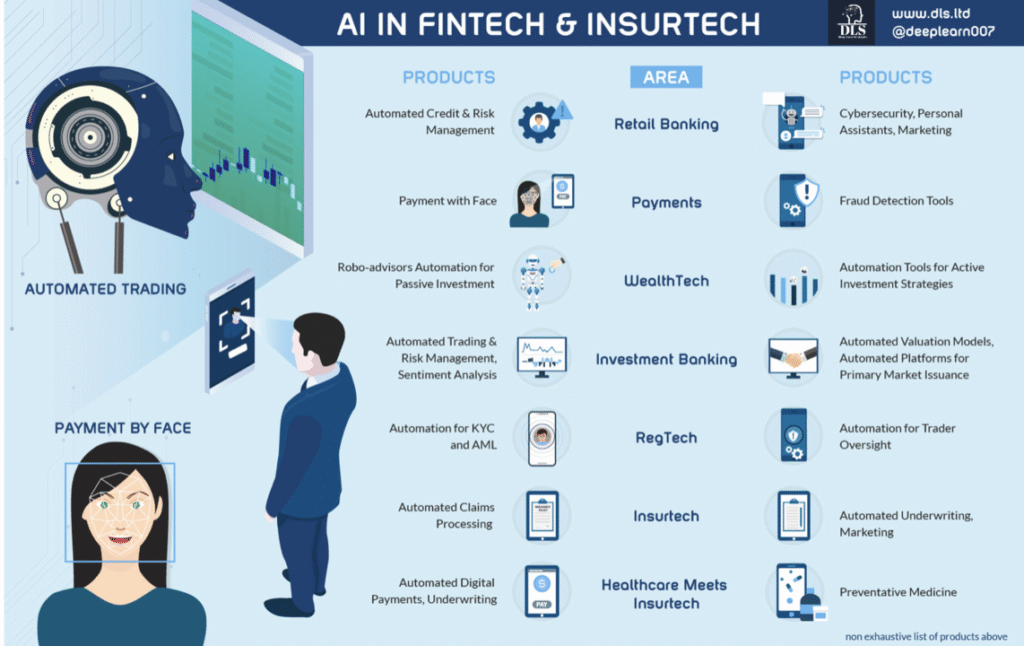

According to CTO Magazine, the AI in the fintech market is expected to reach $53.30 billion in the next five years. This is because the financial world is changing faster than ever before. Financial institutions are no longer just service providers; they are data driven ecosystem that relies on AI to understand customer behavior and deliver instant services.

With AI’s ability to analyze vast amounts of data in real time, Fintech companies can make precise and automated decisions that improve efficiency and security.

We’ll look at how AI is changing finance in this guide, from more intelligent risk management and predictive analytics to quicker transaction automation and more in depth consumer insights.

How Important is AI in Fintech?

AI is the technology that makes sense of all the data that fintech depends on. AI enhances practically every facet of finance, from assessing market risk to automating transactions.

AI is essential to the financial sector because of its ability to learn and adapt. AI systems are constantly evolving with data, in contrast to conventional systems that follow set rules. They spot irregularities and find patterns. It also speeds up decision-making and lowers human mistakes.

Additionally, fintech companies are under pressure to provide innovative solutions as customer expectations for safe financial services rise. By automating manual tasks, AI helps close that gap. AI guarantees accuracy and agility in tasks like high frequency trading and loan default prediction.

1. Smarter Risk Management

Predictive Analytics for Risk Assessment

Predictive analytics is now the cornerstone of modern risk management. Fintech companies may now employ AI to assess potential hazards and big, complex information before they have an impact on company operations.

Predictive analytics, at its core, forecasts future events by combining historical data with behavioral tendencies. For example, by looking at patterns in customer purchasing and credit card usage, AI can determine the likelihood of fraudulent transactions. This functionality may be used by fintech software to identify questionable activities. This helps allow organizations to take proactive measures.

Consider a digital lending platform that uses predictive analytics to evaluate applicants. It uses other information, such as utility payments and even smartphone metadata, in addition to credit history. The AI model gives every candidate a dynamic risk score. This score is updated as new information becomes available. As a result, this guarantees more equitable assessments.

Predictive analytics is used in investment management to assist organizations in anticipating market volatility. Additionally, computers are able to identify price changes or early indicators of economic instability. This allows investors to modify their portfolios appropriately.

Fraud Detection

An ongoing danger to the financial sector is fraud. The speed of modern cyberthreats is sometimes too fast for traditional fraud detection methods, which depend on human inspections and static criteria.

But AI offers a more intelligent and flexible method. In order to detect even the smallest distinctions between the two, machine learning algorithms are able to track millions of transactions in real time and spot minute irregularities that point to fraudulent transactions.

AI algorithms can instantly identify fraudulent activity, for instance, if a consumer who usually makes small purchases suddenly starts huge international transactions at strange hours. As AI models learn from fresh data, they update themselves dynamically, in contrast to traditional systems that depend on fixed parameters. This continuous learning process makes AI based fraud detection far more effective and resilient to changing attacking patterns.

AI plays a major role in preventing fraud for businesses like PayPal. Their systems use neural networks to assess hundreds of transaction characteristics in milliseconds. This ensures that legitimate transactions go without any issues and that fraudulent ones are promptly halted.

Furthermore, AI also assists in identity verification and anti money laundering efforts. Natural Language Processing can analyze customer documents and ensure compliance with KYC regulations.

Credit Scoring and Loan Underwriting

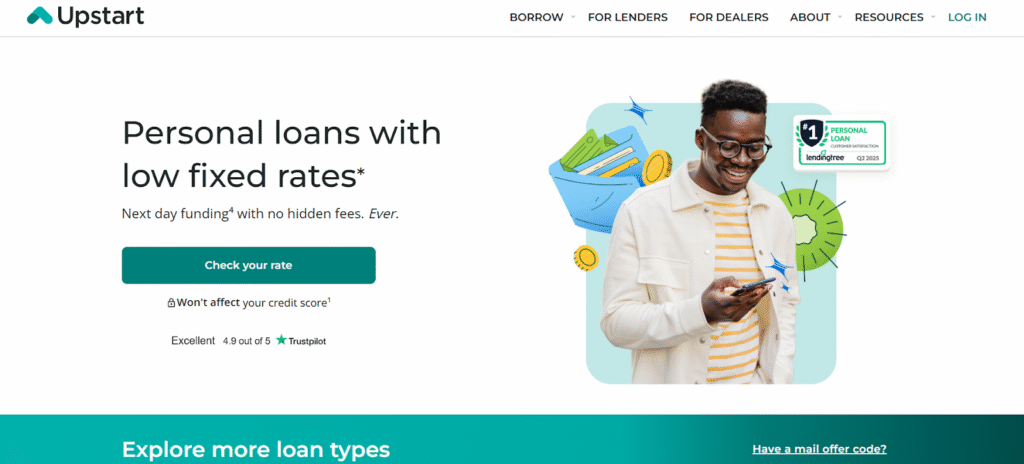

Credit scoring and underwriting are essential processes that determine who gets access to credit and under what terms. Traditional credit scoring systems often rely on limited datasets such as credit bureau reports and employment history. While effective to an extent, these models can be biased and outdated, leaving millions of people without access to fair credit opportunities.

AI transforms this by introducing data rich and intelligent credit evaluation models. Thousands of data points may be analyzed by machine learning algorithms to produce a comprehensive picture of a borrower’s financial activity.

For instance, platforms such as Upstart have taken the lead in creating AI credit rating algorithms that evaluate both standard and unconventional data sources. Their algorithms are able to more accurately assess risk by identifying reliable borrowers that older systems may otherwise overlook, which often reduces default rates.

Furthermore, as fresh repayment data is made accessible, AI algorithms keep improving their models. This flexibility allows lenders to quickly modify lending limitations, guaranteeing financial inclusion while upholding strict risk management.

Market Risk Forecasting

By their very nature, financial markets are unpredictable. Due to their reliance on static assumptions and small datasets, traditional market forecasting models frequently fail. AI changes that by introducing adaptive models capable of processing massive and multidimensional data streams in real time.

Machine learning algorithms analyze structured data alongside unstructured data to forecast market movements with remarkable accuracy. This integration of quantitative and qualitative insights gives investors a holistic understanding of market dynamics.

2. Transactions through AI Automation

Intelligent Payment Processing

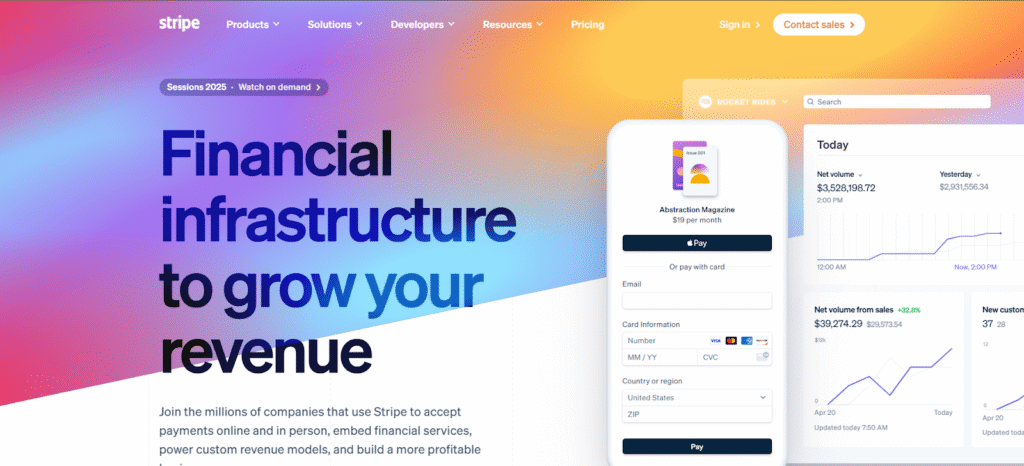

Traditional systems frequently face fraud concerns and bottlenecks when transaction volumes increase dramatically. By offering intelligent payment processing systems that optimize and protect transactions in real time, artificial intelligence addresses these problems.

AI payment gateways examine past transaction data using machine learning algorithms to forecast possible fraud or interruptions. For instance, the system may immediately flag or stop the payment until it is confirmed if it notices an odd transaction frequency or a discrepancy in the device location. By ensuring that only valid transactions are handled, this proactive strategy minimizes erroneous declines and lessens consumer annoyance.

Furthermore, AI optimizes the transaction routing processing. When multiple payment gateways or networks are available, the AI system evaluates them based on parameters like success rates and cost efficiency, then selects the best route automatically.

AI technologies that allow for predictive risk assessment and real time fraud detection have already been implemented by businesses such as Stripe. Through constant learning from transaction outcomes, these systems gradually increase the accuracy of their models.

AI in Algorithmic Trading

Algorithmic trading is one of the most prominent use cases of AI in Fintech. Moreover, it refers to using computer programs to execute trades automatically based on pre defined conditions. Although algorithmic trading has been around for a while, it has reached a whole new level of sophistication with the introduction of AI and machine learning.

In order to find lucrative trading opportunities, AI trading algorithms instantly examine enormous databases. These tools enable businesses to remain ahead of the competition by processing and responding to market developments in milliseconds.

Natural Language Processing for Instant Support

While automation powers the back end of financial operations, customer interactions remains a vital part of the fintech experience. Intelligent and human like consumer contact is made possible by natural language processing.

AI apps can comprehend and react to human language thanks to NLP. These technologies are able to respond to inquiries, assist customers with transactions, and even quickly offer tailored financial advise.

3. Personalization and Customer Insight

Delivering individualized client experiences and relevant business insights is one of AI’s most revolutionary effects in finance. Data intelligence is the foundation of customization. Large volumes of data are gathered by financial organizations from credit behavior, transaction histories, and user interactions.

This data is processed by AI systems, especially deep learning models, to provide comprehensive client profiles. Fintech businesses may provide individualized services like dynamic interest rates with the use of these profiles.

Additionally, AI makes behavioral segmentation possible by breaking down consumers into smaller groups according to their financial literacy or purchasing patterns. Fintech companies may provide pertinent financial goods, such small business loans to startups, thanks to this segmentation.

Challenges of Integrating AI in Fintech

Data Privacy

In fintech, data often includes highly sensitive personal and financial information. One of the most important challenges is protecting data. Strict data protection laws must be followed by financial companies. Any abuse or breach of data may result in serious financial penalties as well as a decline in consumer confidence.

Moreover, the use of AI models introduce new vulnerabilities. Attackers might change algorithms or exploit errors in model outputs to commit fraud. Because fintech platforms are increasingly reliant on cloud AI technology, advanced cybersecurity measures are necessary to secure consumer data.

Regulatory Complexities

The financial sector operates under tight regulatory oversight, and introducing AI systems complicates compliance. Many AI algorithms operate as black boxes, their decision making processes aren’t easily explainable. This lack of transparency is a problem for regulators who must understand the precise process used to generate credit ratings or fraud warnings. The development of accurate and explicable AI systems remains a technological problem.

Integration with Legacy Systems

The legacy IT infrastructures used by many well known financial organizations are frequently incompatible with contemporary AI technology. It can be expensive and technically challenging to include AI models into these systems. Significant obstacles to the smooth implementation of AI are created by data silos and mismatched data formats.

High Implementation Costs

Altough AI offers long term cost efficiency, the initial investment in infrastructure and maintenance can be significant. Budgetary restrictions may prevent smaller fintech businesses from creating and implementing cutting edge AI technologies.

AI system maintenance also entails regular costs and cybersecurity protocol updates. Without strategic financial planning, these costs can outweigh the short term returns on AI integration.

Ethical Issues

AI’s role in decision making raises ethical questions about accountability. Customers want to know how their credit limits are determined or why their loan applications are rejected. Users may become less trusting of the organization if AI systems make these choices with human supervision or justification. Fintech businesses must strike a balance between automation and human judgment in order to preserve confidence.

Best Practices for Integrating AI in Fintech

Prioritize Data Quality

Data quality and governance forms the foundation of any successful successful AI integrations. This entails keeping impartial, accurate databases that adhere to legal requirements in the finance industry. Biased models and erroneous predictions might result from inadequate or missing data.

To mitigate this, fintech companies should:

- Put in place stringent procedures for data validation.

- To safeguard sensitive data, use encryption and data anonymization.

- To keep tabs on the origins and usage of data, set up data lineage monitoring.

- Audit datasets often to make sure they adhere to changing privacy laws.

Build Transparent AI Models

Every choice made in the financial sector has a big impact. AI systems must thus be clear and comprehensible. Fintech firms may better understand their decision-making process with the use of explainable AI. Accountability to consumers and authorities is so guaranteed.

A model’s reasoning for arriving at a certain result can be explained using methods like decision visualization tools and model interoperability frameworks. These procedures boost user trust in automated choices in addition to aiding with compliance. Customers are more inclined to trust AI technologies when they are aware of how they operate.

Strengthen Security

AI integration in fintech demands top tier cybersecurity. Because AI systems manage sensitive transactional and customer data, they are especially susceptible to breaches. A single breach might damage a company’s reputation.

Fintech companies should adopt a security first approach that includes:

- End to end encryption of data in transit and at rest.

- Installation of secure API gateways and multi factor authentication.

- Frequent security audits.

Integrate Human Oversight

Human judgment is still vital despite AI’s accuracy, especially when making significant financial decisions. Fintech companies should adopt human in the loop solutions, which are frameworks where human experts assess AI decisions, to prevent errors. This hybrid approach improves compliance while simultaneously guaranteeing ethical responsibility.

Focus on Ethical AI Development

A key component of responsible finance innovation is ethical AI. The application of AI must be guided by ethical issues as it affects lending and fraud prevention. Fintech companies need to make sure that their algorithms don’t reinforce prejudice. Therefore, you want to set up an ethical council for AI that may assist in evaluating models for inclusion.

Final Words

Fintech is being transformed by AI through automated transactions and more intelligent risk management. Adhering to best practices guarantees success even when integration presents data security and regulatory concerns. Fintech businesses will become more efficient if they strategically adopt AI.