Digital Payments & Wallets

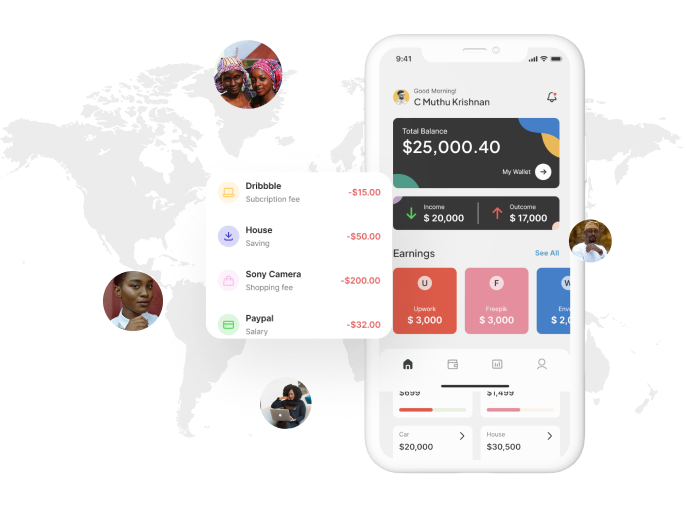

We develop highly secure and user-friendly digital payment solutions that support multiple transaction types, including peer-to-peer transfers and contactless payments. Our digital wallet types feature seamless integration with banks, automated bill payments, and ensure convenience and compliance with global payments standards.

App Development

App Development Modernization of Legacy Finance Software

Modernization of Legacy Finance Software Fintech Software Consulting

Fintech Software Consulting Payment Gateway Integration

Payment Gateway Integration Testing

Testing Data Analytics

Data Analytics Fintech Mobile App Development Services

Fintech Mobile App Development Services