According to a report, 21% of adults in Asia have access to a bank account or a mobile money provider. However, the digital finance revolution is changing all that. Furthermore, the centralized, paper based system has evolved into a decentralized, automated system.

This continuous transformation, also known as the digital finance revolution, involves more than just implementing new technologies; it involves completely reimagining financial procedures. It also involves utilizing technology to enhance transparency and identify wealth.

So, in this guide, we will walk you through what digital finance entails and its impact on business operations.

The Digital Finance Revolution

The digital finance revolution has had a major influence on how financial services are delivered and integrated into business processes. Furthermore, in order to bring the financial infrastructure into line with customer expectations, a thorough redesign is required rather than just digitizing current processes. This shift is changing the definition of finance in the digital era like fintech apps.

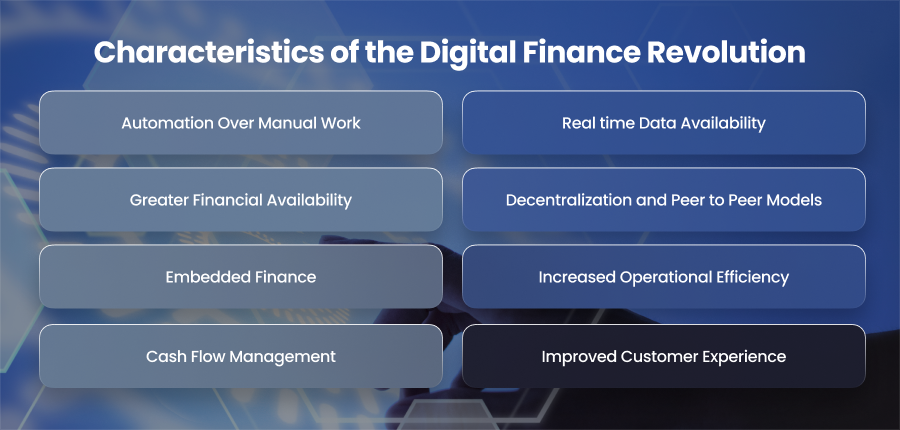

Characteristics of the Digital Finance Revolution

Automation Over Manual Work

The automation of hitherto very laborious financial operations is one of the most notable features of the digital finance revolution. These days, human support may be minimal for chores like invoicing and bank reconciliations. AI and machine learning powered tools examine trends and identify abnormalities. For companies, this translates into huge cost savings. Additionally, instead of spending hours on monotonous work, automation frees up financial staff to concentrate on growth planning.

Real time Data Availability

Digital finance platforms provide businesses with instant access to financial data across accounts. Moreover, digital tools offer dynamic dashboards and live data feeds. Making better decisions is made possible by this real-time data visibility into revenue and financial health. For instance, instead of learning about a problem weeks later, a business may take quick remedial action in response to an unexpected rise in costs or an odd drop in sales. Additionally, real time data improves agility, enabling companies to react swiftly to user requests.

Greater Financial Availability

Access to financial services is becoming more accessible to everybody because of the digital finance revolution. Startups and small businesses now find it simpler to get loans and manage complex finances thanks to platforms that offer digital banking and reasonably priced accounting software. Furthermore, mobile first technology and user friendly interfaces make it possible for even non experts to manage their accounts efficiently.

Decentralization and Peer to Peer Models

The transition from centralized to decentralized systems is another characteristic that sets digital money apart. Peer to peer finance models made possible by technologies like blockchain are doing away with the need for conventional middlemen like banks. Additionally, companies can lend and invest directly with other organizations using decentralized finance platforms, frequently at reduced rates and with more transparency.

Moreover, smart contracts, which automatically execute financial agreements when specific conditions are met, add another layer of efficiency. Hence, this decentralization empowers businesses with greater control over their assets and reduces dependency on legacy financial systems.

Embedded Finance

Embedded finance refers to the seamless integration of financial services into non financial platforms, such as eCommerce sites and enterprise software. Businesses may now provide finance and even investment choices directly inside their own ecosystems, eliminating the need to send consumers to third-party banks or payment platforms. For example, a SaaS provider may let users pay in monthly installments by offering a “buy now, pay later” option. This increases client loyalty and creates additional income sources in addition to improving user comfort.

Increased Operational Efficiency

One of the most immediate and noticeable benefits of digital finance is the boost in operational efficiency. Tasks such as invoice generation and tax reporting are streamlined through intelligent software and cloud based tools. Moreover, this not only reduces human error and dependency on spreadsheets but also minimizes administrative overhead. Hence, this result is a leaner finance operation that runs faster and with fewer resources, allowing your team to focus more on value driven analysis rather than time consuming manual work.

Cash Flow Management

Better cash flow monitoring and forecasting are made possible by real-time access to revenue and cost data. Predictive analytics is a feature of many digital financial platforms that helps companies foresee potential cash shortages. Leaders are better equipped to decide when to acquire money or make investments when they have this insight. Businesses with varying revenue streams or those that operate seasonally will find this very helpful. More sustainable growth follows from improved cash flow management.

Improved Customer Experience

As more and more financial services are included into digital interactions, customer experiences are evolving. Today’s consumers want financial transactions to be secure and simple, whether that is acquiring flexible financing choices or making payments via a smartphone app. By enabling faster checkout times with digital finance solutions, businesses may enhance the consumer experience.

What Technologies Drive the Shift?

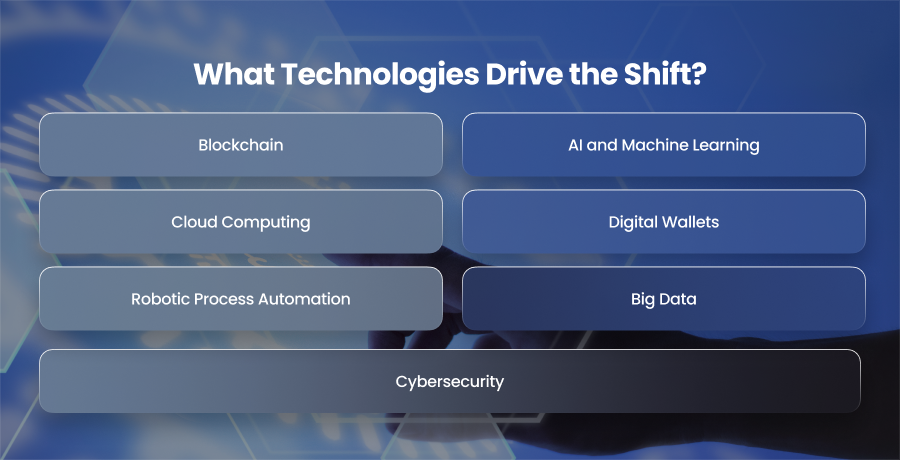

Blockchain

A decentralized ledger system called blockchain makes sure that transactions are accessible and unchangeable. Additionally, all participants can see every financial transaction that is recorded on the blockchain. It is therefore perfect for lowering fraud and fostering trust. Cryptocurrencies like Bitcoin enable speedy financial transactions without the use of banks or other traditional financial intermediaries by utilizing blockchain networks.

AI and Machine Learning

AI and ML are changing finance by accelerating and enhancing data driven decision making. Large volumes of financial data may also be analyzed by these technologies to identify patterns and anomalies. AI is utilized in digital finance to automate credit scoring and customize client interactions.

As machine learning models gain accuracy over time, cash flow forecasting may be continuously improved. AI gives companies a strategic edge in comprehending and predicting financial dynamics in addition to automation.

Cloud Computing

Cloud computing enables businesses to store and process financial data in secure, scalable environments accesible from anywhere. Unlike on premises financial systems that are often expensive and rigid, cloud based finance platforms offer flexibility and real time data access. Cloud services also support collaboration and executives to work together from different locations without version control issues. Meanwhile, APIs act as digital bridges between software systems and enable seamless dataflow between tools like CRMs.

Digital Wallets

The usage of digital wallets in corporate and consumer transactions is growing. These technologies let people to safely store and transfer money via smartphones and other connected devices. Because contactless payments are so popular, businesses can now provide checkout experiences that are safer. This lessens the sales process’s friction. For businesses, accepting digital wallets open new revenue channels.

Robotic Process Automation

RPA refers to software bots that can mimic human actions to complete repetitive tasks with high accuracy. RPA is capable of handling tasks like compliance inspections and invoice processing in the banking industry. These bots also work well and lower the possibility of human mistake. Additionally, RPA and AI combine to create intelligent automation, where bots do tasks.

Big Data

Strategic insights can be gleaned from the vast amount of financial and transactional data generated. Big data technologies also give companies the ability to manage and analyze enormous information from a variety of sources, including consumer transactions and economic indicators. This data becomes an effective tool for controlling financial risk.

Cybersecurity

As financial institutions move toward digitalization, protecting sensitive data is becoming increasingly important. Many individuals use biometric technologies, such fingerprint scanning, to safely access their bank accounts these days. These methods are more secure than traditional passwords.

Impact on Business Operations

Enhanced Liquidity Management

Any organization depends on its cash flow, and digital financial solutions are revolutionizing the way it is handled. Businesses may now foresee future financial demands and any shortages before they happen thanks to intelligent forecasting. Businesses that have erratic income cycles or are seasonal will find these insights very helpful. Additionally, automatic notifications and real time transaction tracking make sure that financial reserves are spent prudently and invoices are paid on schedule.

Agility in Global Expansion

Selling to and collaborating with customers worldwide is now simpler than ever thanks to globalization. But conventional finance systems frequently fall behind. But digital finance tools are changing that. With multi currency payment processors and cloud tax calculators, companies can operate globally without needing a complex web of local financial institutions. These technologies enable real time currency conversion and easier alignment with regional financial regulations.

Data Driven Risk Management

Risk management is very important. Digital finance solutions assist businesses in proactively identifying and addressing financial issues by analyzing historical trends. For instance, companies can monitor customer purchasing trends. AI risk models can also simulate various economic scenarios to guide decision making. Hence, this kind of foresight helps organizations reduce exposure and maintain financial stability during volatile times.

How Businesses Can Prepare?

Conduct a Comprehensive Financial Technology Audit

The first step toward digital finance transformation is understanding your current financial environment. In a financial technology audit, the platforms and tools your company utilizes for reporting and accounting are evaluated.

Therefore, you may more effectively prioritize what needs to be improved or replaced by finding gaps and inefficiencies in your present configuration. This audit also help define the functional requirements for any new digital finance tools you plan to implement.

Adopt Cloud Based Financial Problems

Cloud computing is foundational to digital finance. It facilitates distant cooperation and provides real-time access to financial data. All types of businesses benefit from the scalable solutions provided by programs like QuickBooks.

Businesses may use built in analytics to predict cash flow and automate invoicing by moving to the cloud. Through APIs, many of these platforms also easily interface with financial institutions. This increases accuracy and lessens the need for human data entry.

Integrate Automation

To fully utilize digital finance, businesses should look for opportunities to automate routine tasks. Moreover, accounts payable and receivable and report generation are all processes ripe for automation. Tools that use robotic process automation or AI workflows can save time and lower operational costs.

Start small by automating high volume and then gradually expand. For example, setting up automated invoice reminders to clients can improve cash flow without requiring any staff.

Upskill Your Financial Team

Technology is only as effective as the people using it. A major barrier to successful digital finance adoption is the skills gap. Finance professionals must now understand data analytics and even cybersecurity fundamentals.

So, you should invest in ongoing training to help your finance team develop the digital competencies require to navigate this new environment.

Improve Cybersecurity

Businesses are more susceptible to hackers as they move to digital banking platforms. Given how often hackers target financial information, it is imperative to have robust security measures in place. Also, you should platforms with built in encryption and role based access control. Moreover, you should regularly update your software to patch vulnerabilities.

Compliance is another critical component. Different countries have varying laws related to data protection and digital transactions. Hence, you should ensure your digital financial solution aligns with applicable standards.

Partner with Fintech Providers

Businesses can speed up the digital finance revolution by collaborating with specialist fintech companies instead of doing everything themselves. These companies supply everything from AI analytics to integrated financing and digital payments. Additionally, you may acquire contemporary skills through fintech alliances without having to pay for expensive bespoke development.

Stay Agile

The process of digital transformation is ongoing. Financial rules and new technology are always being developed. For this reason, it’s critical to collect user input and conduct routine performance reviews of your digital banking systems.

As a result, you should schedule regular evaluations to evaluate the return on investment of your workflows and technologies. To make sure that your financial operation stays effective, you need also promote a culture of continual development.

Final Words

The revolution in digital transformation is changing how companies function and expand. As a result, businesses may employ automation to enhance consumer experiences. Therefore, preparedness with the right instruments ensures long term success.